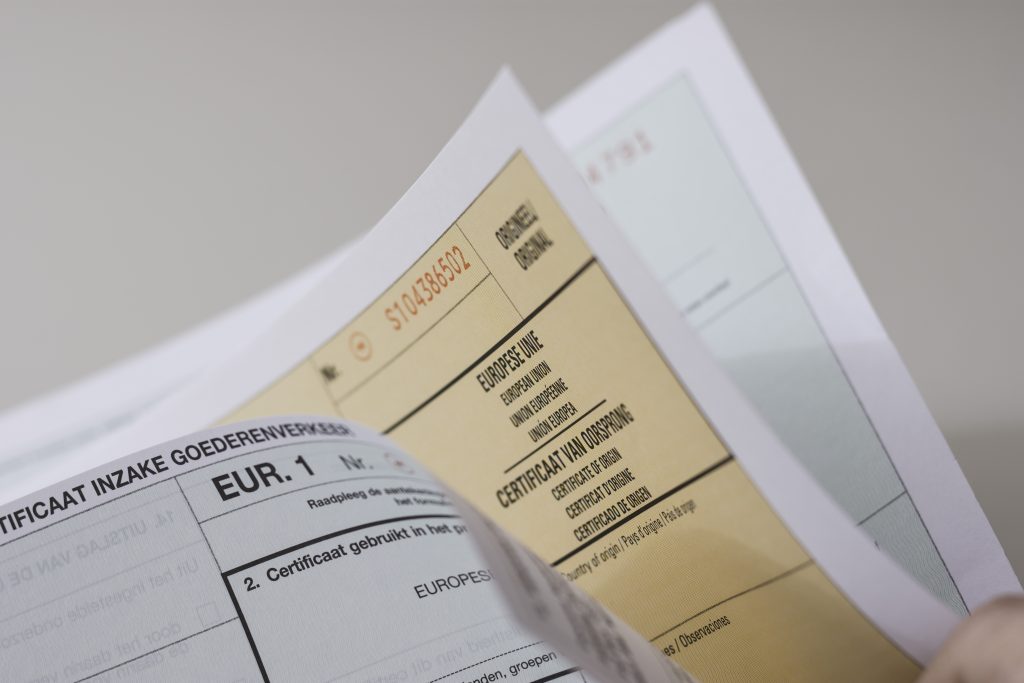

The concept of the price of customs clearance in customs processes as such does not exist. This phrase is rather colloquial. By customs tariffs we mean the calculation of customs duties, which is carried out in two ways.

* When setting customs prices, the customs authorities may first be guided by the customs value provided by the declarant importer. In this case, the customs authorities agree with the customs value of the goods submitted by the importer, and accordingly determine the appropriate customs clearance prices.

This applies in several cases. For example, for goods purchased in a duty-free store, if there is a receipt issued by the store. Also, in the case of import of goods by legal entities issued by large foreign companies according to the list determined and published by the customs administration, and having distribution, dealer and agency powers of attorney.

However, not in all cases, the customs authorities, when determining customs prices, take as a basis the transaction price presented by the declarant. This may be the case when the importer presents deliberately low and unrealistic customs prices for goods, and it is impossible to determine clear customs prices based on the submitted documents.

In such a situation, the customs authorities use several methods.

* The customs value of imported goods is determined immediately after the moment of import, but not later than within 90 days, based on the selling price of a unit of these goods, identical or homogeneous goods. At the same time, the goods must have the same country of origin and be imported from the same country. That is, documentary data on customs prices submitted by another company importing the same goods to the Republic of Armenia are taken as a basis.

Another option is when customs prices are determined for RA exports based on the price of the same goods sold in the same or almost the same export country for the same or almost the same period of time.

Would you like to know more about customs clearance prices and their calculation methods? Contact a customs broker. Register on the Brokers.am website, fill out an application and receive many offers of customs broker services.

Make your cargo clearance smart and efficient with the Brokers.am platform.